The Centers for Medicare & Medicaid Services (CMS) released its 2,475-page 2020 Medicare Physician Fee Schedule Final Rule (Final Rule) on November 1, 2019. Noting that only 9% of Medicare fee-for-service beneficiaries presently receive ambulatory-care management services, CMS is making several important changes to expand access to these services.

The following insight summarizes new Medicare reimbursement rules for transitional care management, chronic care management, principal care management, and remote patient monitoring.

According to CMS, a recent analysis of TCM claims data determined that “beneficiaries who receive TCM services demonstrated reduced readmission rates, lower mortality, and decreased healthcare costs.” The same analysis, however, “found that use of TCM services is low when compared to the number of Medicare beneficiaries with eligible discharges.” In fact, providers submitted only 1.3 million claims for TCM in 2018, compared to approximately 9.5 million Medicare hospital discharges that year.

To increase TCM utilization, CMS is reducing the administrative burden associated with billing TCM services. Specifically, CMS is eliminating the prohibition on a practitioner billing for certain services furnished during the 30-day period covered by TCM. Most importantly, a practitioner will be able to bill for chronic care management (CPT® codes 99490, 99491, 99487, and 99489) and care-plan oversight (HCPCS G0181 and G0182) furnished during the same time period as TCM.

Also, CMS is improving payment for TCM by increasing the work relative value units (RVUs) for the two TCM CPT codes. For CPT 99495, payment is increasing from $166.50 to $175.76. For CPT 99596, it will increase from $234.97 to $237.11. (Please note, we use the non-facility national payment rate calculated with the 2020 conversion factor of $36.09 throughout this article, unless noted otherwise.)

For detailed information on TCM reimbursement rules, view PYA’s white paper, Providing and Billing Medicare for Transitional Care Management, at https://bit.ly/39tYONt.

CHRONIC CARE MANAGEMENT (CCM)

As with TCM, CMS notes that CCM is “increasing patient and practitioner satisfaction, saving costs and enabling solo practitioners to remain in independent practice.” Like TCM, however, CCM “continue[s] to be underutilized.”

To address this, CMS is creating an add-on code for non-complex CCM, HCPCS code G2058. Effective January 1, 2020, a practitioner can bill CPT 99490 for the first 20 minutes of clinical staff time spent performing CCM activities in a given calendar month, and can bill G2058 for the second and third 20-minute increments. Payment for CPT 99490 is $42.23, while each add-on code (up to two) pays $37.89. Thus, total reimbursement for an hour or more of non-complex CCM services is $118.01.

CMS is making one minor revision to the list of items typically included in the required comprehensive care plan, replacing “community/social services ordered, how the services of agencies and specialists unconnected to the practice will be directed/coordinated, identify the individuals responsible for each intervention” with this language: “interaction and coordination with outside resources and practitioners and providers.”

CMS is also revising the care-planning element for complex CCM (CPT 99487 and 99489). CMS will now interpret the code descriptor “establishment or substantial revision of a comprehensive care plan” to mean that a comprehensive care plan is established, implemented, revised, or monitored.

For detailed information on CCM reimbursement rules, view PYA’s white paper, Providing and Billing Medicare for Chronic Care Management, at phyins.com/pya-ccm.

PRINCIPAL CARE MANAGEMENT (PCM)

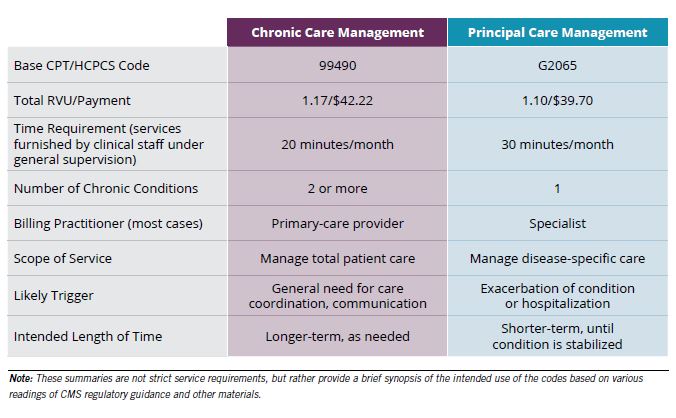

Effective January 1, CMS will reimburse for PCM furnished to beneficiaries with a single chronic condition. The following table identifies the key differences between CCM and PCM services.

Concerned about paying for duplicative services, CMS includes two additional requirements for PCM: (1) the practitioner billing for PCM must document in the patient’s record ongoing communication and care coordination between all practitioners furnishing care to the beneficiary; and (2) the practitioner cannot bill for inter-professional consultations or other care-management services (excluding remote patient monitoring for the same beneficiary for the same time period as PCM).

As with CCM, CMS will reimburse for PCM services furnished directly by a physician or non-physician practitioner (as opposed to clinical staff under general supervision) under HCPCS code G2064. Payment will be $78.68 for 30 minutes, or more for care-management services.

Finally, CMS declined to create an add-on code to reimburse for time spent beyond 30 minutes per month providing PCM. The agency noted that it will monitor PCM utilization to determine whether such additional reimbursement is warranted.

REMOTE PATIENT MONITORING (RPM)

Similar to non-complex CCM billed under CPT 99490, RPM billed under CPT 99457 requires 20 minutes of clinical staff time per calendar month reviewing and taking action based on data reported through RPM, including interactive communication with the patient or caregiver. CMS has previously required the billing practitioner to provide direct supervision (i.e., in-person) for clinical staff furnishing RPM services. Effective January 1, CMS will permit these services to be performed under general supervision.

Also, CMS has created an RPM add-on code, CPT 99458, similar to the non-complex CCM add-on code. Effective January 1, 2020, a practitioner can bill CPT 99457 for the first 20 minutes of clinical staff time spent performing RPM activities, and CPT 99458 for the second and third 20-minute increments. Payment for CPT 99457 is $51.63, while each add-on code (up to two) pays $42.23. Thus, total reimbursement for an hour or more of RPM services is $136.09. (Unlike non-complex CCM, CMS did not explicitly state only two units of CPT 99458 can be billed each calendar month. This limitation, however, is implicit in CMS’s discussion regarding the RPM codes.)

CMS noted that “[s]everal commenters expressed concerns about the ambiguity of the code descriptors for the RPM codes.” The agency responded that it “appreciate[s] the many questions raised by commenters about the set of RPM codes and understand[s] the frustration commenters expressed with the current code descriptors. Therefore, given the numerous questions raised by commenters, [CMS] plan[s] to consider these and other questions related to RPM in future rule-making.”

For detailed information on RPM reimbursement rules, view PYA’s white paper, Providing and Billing Medicare for Remote Patient Monitoring, at https://bit.ly/2uuTs5X.

If you would like more information about the Final Rule and reimbursement for care management, or would like assistance with any matter involving strategy and integration, compliance, or valuation, contact one of our PYA executives, Martie Ross or Lori Foley, at (800) 270-962PR9.

PYA helps clients navigate the complex challenges related to regulatory compliance, mergers and acquisitions, governance, business valuations and fair-market-value assessments, and more. For more information, please visit www.pyapc.com.