Loss Severity and Hardening Market Persists

Since the founding of our company almost 40 years ago, our mission has been to serve our members with exceptional medical professional liability insurance (MPLI) products, provide pro-active and informative risk management resources to help avoid claims, and deliver superior service if a claim does occur. All of this is backstopped by a commitment to be good stewards of your capital, to protect and enhance policyholder surplus, and to manage the company in a financially responsible way that always puts members first.

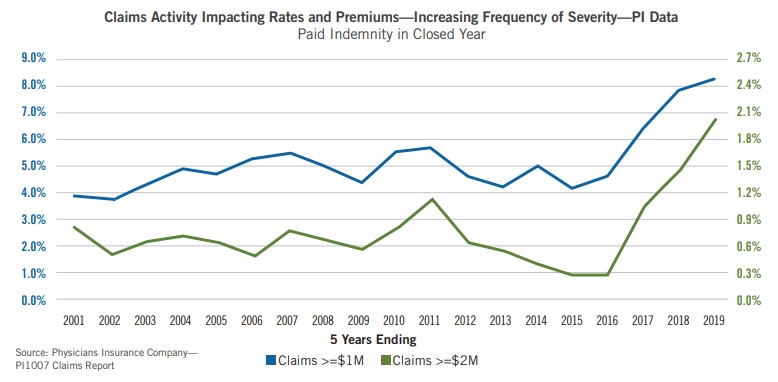

Just as the healthcare landscape has changed over the years, so too has the legal climate. Across the industry there has been a vast increase in mega-verdicts including a record number of $100 million plus verdicts in the past several years. In the Pacific Northwest, we have seen a huge increase in high severity losses with our own paid indemnity for claims paid increasing 30% in Washington and quadrupling in Oregon over the 2015-2019 period relative to 2010-2014. It’s too early to identify where 2020 and 2021 will ultimately end but the negative trending has remained consistent.

Not only are claims resolving for more indemnity (the sum of money paid out in the claim), but they are also costing much more to defend. At Physicians Insurance we look out for the best interest of our insureds, whether that be vigorously defending a non-meritorious case or paying a fair settlement when appropriate. Our deep knowledge and claim handling expertise led to successful results: in the fifteen-year period from 2005 through 2020 we had more than 142 defense verdicts in public trials achieving an overall 94% defense win rate. We accomplished this result for our members by utilizing the most targeted and qualified counsel, defense experts, focus groups, and mock trials to assist in defense strategy. Understandably, there is a cost associated with this rigorous defense, and the cost to defend a claim has increased by nearly 50% since 2007.

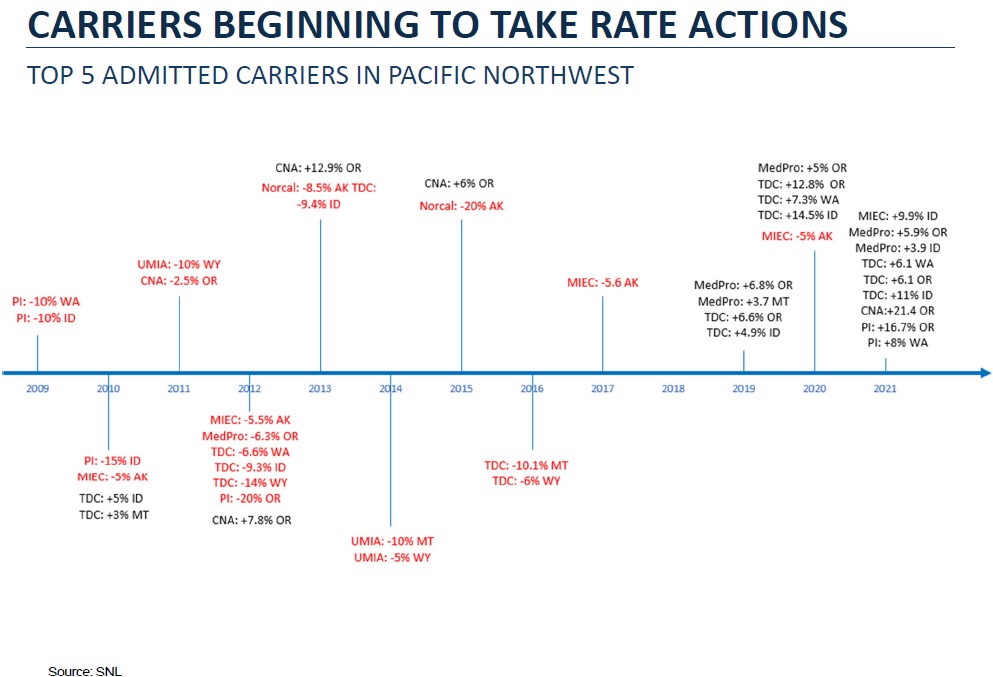

As a result of the increases in claims severity, legislative actions, the cost to defend claims, and overall social inflation among other factors, medical professional liability insurers across the nation have been negatively impacted. AM Best (a national, independent rating agency of insurance companies) has put the entire industry on Negative Outlook. In response, the property and casualty insurance industry, and medical liability insurers in particular, have had to take steps to improve financial performance. In the last three consecutive years, other major carriers in the Pacific Northwest have all raised their premium rates, some in excess of 20%.

Physicians Insurance has not been immune to these trends. Until last year, we had not implemented a premium rate increase in more than 15 years. In fact, we decreased rates twice during that time. However, to meet our mission to protect policyholder surplus and to manage the company in a financially responsible manner, we had to increase our premium rates for the 2021 policy year, and we will need to do so again for 2022. We have been approved for an 8% base rate increase in Washington. Your broker or Physicians Insurance underwriter will be able to address how this will impact your specific policy renewal, but please know that we are looking to apply the least possible rate increase that we can justify while maintaining our commitment to be financially responsible. Additionally, due to an historically low interest rate environment coupled with the extraordinary increase in claims costs, we are evaluating if it will be financially prudent to pay a dividend in 2021.

As a mutual company owned by and operated for the benefit of its members, we plan to continue insuring, defending, and supporting our members well into the future with exceptional insurance products, superior risk management and claims servicing, all backstopped by an extremely strong balance sheet (in fact, in September 2021, AM Best affirmed Physicians Insurance's credit rating as A- (Excellent) with a stable outlook). We know that the past 18 months have taken a huge toll on the medical community. While we look at the impact this is having on burnout, staffing shortages, and the uncertainty created by the pandemic and changing healthcare delivery landscape, our commitment to you remains steadfast.

Physicians Insurance is owned and directed by you, our member-owners. We rely on each other during both easy and unprecedented times. We are grateful for the opportunity to support and protect you, our members. We hope you see the long-term value of your company – knowing that in the long run we will get through this together. There is always one thing you can count on:

Physicians Insurance will be alongside you every step of the way. After all, we are your company.

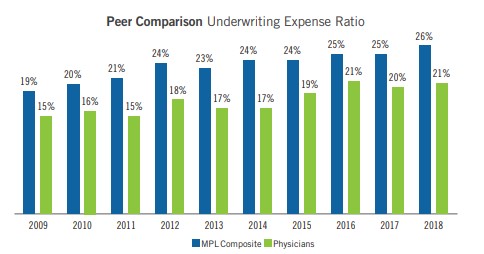

PI is not at financial risk. By all key metrics PI is financially strong. PI’s Underwriting Expense Ratio is consistently lower than our peer group: which means we consistently spend much less to run our business.

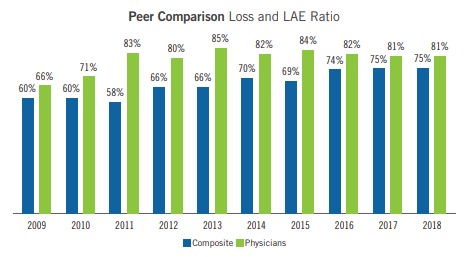

However, we do outspend our peer set on defending our members and paying claims because we work in environments with no tort reform as well as we are willing to spend money needed to defend a case and take it to trial.

Because our focus is always on the member, since 2015 we have operated at an underwriting loss. Despite rising case defense expenses and reinsurance costs, the investment income PI has offset the underwriting losses. However, along with the now historic lows in interest rates, these underwriting losses are unsustainable, and we need to make changes now to be able to continue to provide future coverages.

In September 2021, AM Best affirmed the financial strength rating for Physicians Insurance as A- Excellent with a stable outlook. This rating affirms our excellent ability to meet our ongoing insurance obligations.

A.M. Best’s ratings are on a scale from A++ (superior) down to D (poor), with even lower ratings for companies under regulatory supervision or in liquidation.

While we have avoided raising rates for several years, some of the states we serve will see an increase in 2022 (effective 1/1/22):

- WASHINGTON

The base rate increase for Washington is 8%.

- OREGON

The base rate increase for Oregon is 15%.

As a result of the increases in claims severity, legislative actions, the cost to defend claims, and overall social inflation among other factors, medical professional liability insurers across the nation have been negatively impacted. AM Best (a national, independent rating agency of insurance companies) has put the entire industry on Negative Outlook. In response, the property and casualty insurance industry, and medical liability insurers in particular, have had to take steps to improve financial performance. In the last three consecutive years, other major carriers in the Pacific Northwest have all raised their premium rates, some in excess of 20%.

Physicians Insurance has not been immune to these trends. Until last year, we had not implemented a premium rate increase in more than 15 years. In fact, we decreased rates twice during that time. However, to meet our mission to protect policyholder surplus and to manage the company in a financially responsible manner, we had to increase our premium rates for the 2021 policy year, and we will need to do so again for 2022.

This is really a difference between past performance of the company versus current and future results.

For the past several years the company has relied on investment income to offset underwriting losses. This is no longer possible due to the combined impact of social inflation (which is increasing verdict and claim amounts) along with the continuation of historically low interest rates. This means the current base premiums are insufficient to cover projected losses and the buffer of investment income is no longer capable of offsetting losses.

At the same time, Physicians Insurance has returned a portion of its policyholder surplus to members in the form of a dividend. That means for those earlier years, there was more premium earned than was needed to cover losses and expenses.

Due to an historically low interest rate environment coupled with the extraordinary increase in claims costs, we are evaluating if it will be financially prudent to pay a dividend in 2021.

Contact your broker, or Physicians Insurance underwriter to learn more about how the market may be impacting your rates for 2022. You can reach us by calling 800-962-1399.