COVID-19 delivered a shock to the U.S. healthcare system that will change it forever.

The array of disruptions has been staggering, including:

- Non-essential procedure suspensions

- Global medical supply-chain disruptions

- Local, regional, and national equipment shortages

- Market-specific patient-volume surges

- An overnight switch to telehealth care delivery

As a result, the U.S. healthcare economy ground to a halt. It is important to understand how the effects of the shock—or rather, shocks—will impact what was already a changing healthcare-industry structure, and the potential implications for merger and acquisition activity in the provider sector.

EXAMINING SHOCKS: WHY COVID-19 IS SO DISRUPTIVE TO THE HEALTHCARE INDUSTRY

Shocks like these are not unusual in modern economies. But most often being driven by unforeseen, overlapping macroeconomic factors, they can reverberate globally, impacting multiple industries for varying durations. Conversely, they can be regional/national, and impact single industry sectors.

As shown in Exhibit 1, the COVID-19 pandemic triggered four economic shocks (supply, demand, financial, and policy) and evolved over an abbreviated timeline, which intensified its impact (see Exhibit 2). The timeline indicates the predicted peak in cases and overlays the shocks and various events. At this point, the prospect of a quick recovery remains uncertain.

POST-PANDEMIC PROVIDER REALIGNMENT

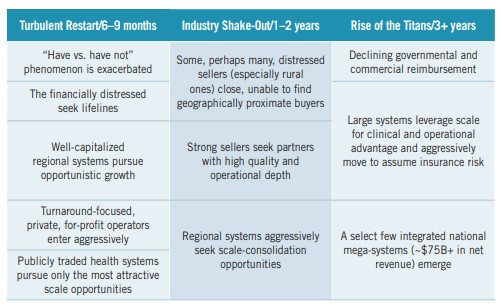

The crisis has exposed the high “cost of fragmentation” within the healthcare industry and, we believe, will serve as the seminal event that ushers in an era of greater provider integration and concentration. We anticipate three phases in the industry’s path forward:

- A turbulent restart will occupy the remainder of 2020, marked by initially sluggish M&A activity as at-risk providers seeking shelter are courted by cautious buyers assessing their positions and plotting strategies.

- In the ensuing two years, a shake-out will occur, characterized by some of the surviving providers and hospitals—their risk tolerances battered—seeking safety and security. Strong regional systems, insurers, and private equity–backed disruptors will seize the opportunity and be hyperactive in pursuing scale during this phase.

- In a final phase, the rise of the titans, national mega-systems, possessing regional market essentiality, may emerge to dwarf today’s largest systems. These behemoths will compete directly with scaled, nontraditional, ambulatory-centric networks (e.g., integrated insurance companies) in a marketplace that no longer adheres to traditional delivery vs. financing distinctions. These organizations will vie to deliver on the promise of population health and achieve growth and stability through quality and efficiency.

HOSPITALS

Hospitals had already experienced a decade of disruptive change pre-pandemic. Post-pandemic circumstances will act as a catalyst to advance the most stubborn of the changes yet to be widely adopted, and will drastically accelerate the pace of many others.

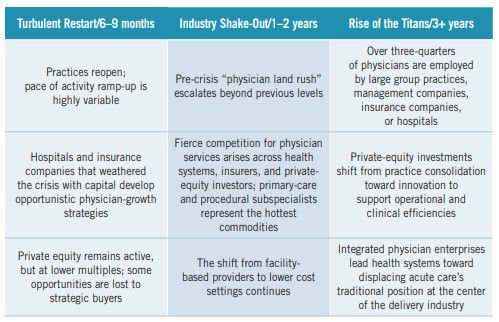

PHYSICIANS

COVID-19 underscored the inherent risks in small independent and group practice amid economic crises. With a high fixed overhead and limited, if any, reserves or credit, some groups failed only days after elective procedures were suspended and well-care visits dried up.

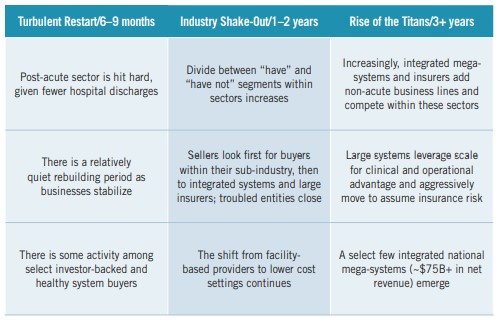

NON-ACUTE PROVIDERS (SENIOR LIVING, HOME HEALTH, BEHAVIORAL, OTHER)

Each non-acute sector has faced unique COVID-19 challenges, but their paths out of the pandemic will share similarities shaped by industry forces. Market consolidators will hedge against the cost of fragmentation by building comprehensive networks for well care, sick care, and recovery care, while private equity continues to consolidate holdings to eventually exit or, in rare and high-growth situations, take public.

THE ROAD AHEAD

The COVID-19 crisis laid bare the fragility of U.S. healthcare. We paid a heavy price for fragmentation. Looking forward, boards and executive teams will need to take several actions to keep their organizations relevant and healthy:

- Evaluate the degree to which local markets are integrating to compete on quality and efficiency

- Identify COVID-19-era competitive differentiators, and re-visit strategic plans to incorporate

- Identify partnerships and structures that will leverage differentiation and support the organization’s long-term success

There will be no going back to the industry as it existed, only a going through to a stronger, more hardened, and—in some cases and geographies—a materially scaled healthcare system. Successfully approaching and navigating such an uncertain future will require healthcare leaders to ask a number of existential questions, including:

- Do we have the financial wherewithal to survive the crisis and a potentially slow recovery?

- Can we articulate a credible path to future practice or system growth?

- Can we continue to successfully compete in a marketplace that prizes integration and scale?

Different organizations will answer these questions differently—but all should proceed based on their answers to them, and to other questions that may be dictated by their particular markets.

Key Takeaways

COVID-19 will accelerate U.S. healthcare’s movement toward a future characterized by the blurring of traditional lines between care delivery and financing. Integrated, scaled regional and national organizations that compete aggressively on quality and cost will lead. Increased merger and acquisition activity will be a hallmark of the transition.

To help their organizations navigate these changes, healthcare leaders should:

- Conduct a forthright evaluation of their organization’s go-forward strategic and financial position

- Revisit growth plans to determine their continued validity

- Create a scenario plan to identify key assumptions or market events that could materially impair organizational performance

- Chart a course forward that reflects the realities of operating in a post-COVID-19 world, including partnership models of all kinds

For more information about the impact of the COVID-19 pandemic on provider alignment, please contact:

Brian Fuller, Principal, PYA, P.C.

(312) 451-6319, bfuller@pyapc.com

Jordan Shields, Managing Director,

Juniper Advisory, (312) 506-3005

jshields@juniperadvisory.com

This article was originally published by The Governance Institute in BoardRoom Press, in the June 2020 edition.