In the 35 years since the Medical Professional Liability Association has been compiling information from insurers, diagnostic error has consistently been one of the top reasons doctors are sued.

P. Divya Parikh, Vice President of Research and Education at the MPL Association, oversees the organization’s Data Sharing Project (DSP), the nation’s largest ongoing independent collaborative database of medical professional liability claims and lawsuits. “Diagnostic error has been the number-one or number-two area of claims activity historically, since we’ve had this database,” she says. “Cost aside, the impact on medicine in general is enormous. A primary reason to see a clinician is to answer a diagnostic question, so reducing diagnostic errors is important. The data helps us understand the claims and where the gaps are, and helps pinpoint where we can work to reduce errors and improve delivery of care.”

In a recent review of closed claims from 2016 to 2018, the DSP reported 18,724 closed claims, with 5,305 resulting in indemnity payment, for a total of $2 billion in total indemnity paid, at an average of $371,560 per indemnity paid.

The below table shows the chief medical factors by closed claims in diagnostic errors from 2016 to 2018:

The top resulting medical conditions by closed claims in diagnostic error during that two-year period were:

• Cardiac arrest

• Cerebral infarction

• Lung cancer

• Pulmonary embolism

• Other sepsis

• Emotional distress

• Aortic aneurysm and dissection

TOP SPECIALTY CLAIM TRENDS

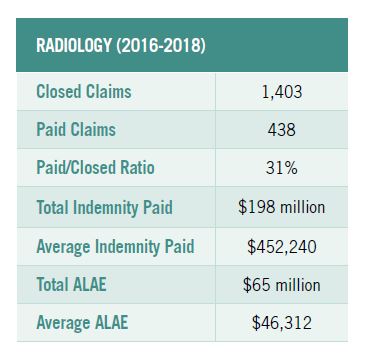

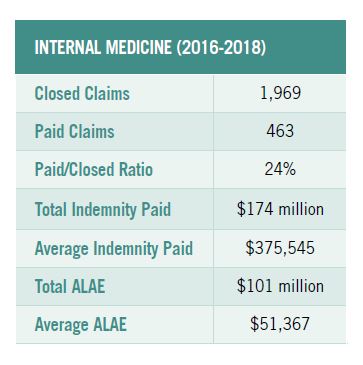

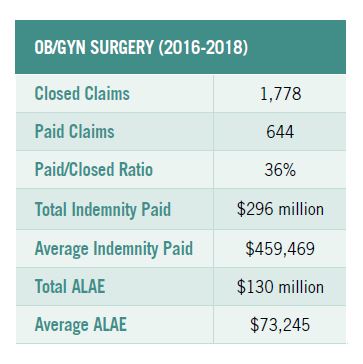

The top specialties by closed claims for diagnostic error in 2016–18 were radiology, internal medicine, family medicine, obstetrics and gynecology surgery, internal medicine subspecialties, and emergency medicine. Radiology had the highest percentage of diagnostic-related closed claims at 77%, compared to 17% of closed claims related to procedure. (Compare that to internal medicine, where 47% of closed claims were diagnostic-related and 30% were procedure-related, and to ob/gyn surgery, where 25% of closed claims were diagnostic and 66% were procedure-related.)

The most prevalent and most expensive outcome for diagnostic claims in radiology was breast cancer. The largest payment reported for a radiology claim was $3.7 million. This claim was for a diagnostic error in which the patient presented with atypical headache syndrome and a CT scan was performed. The resulting medical condition was a nontraumatic subarachnoid hemorrhage, leading to a lifelong medical condition.

Top-resulting medical conditions named in internal-medicine claims for diagnostic-related issues included cardiac arrest, lung cancer, and cerebral infarction. The largest indemnity payments reported for internal-medicine claims were two at $2 million each: one for diagnostic error, in the case of a patient presenting with pain in the throat and chest resulting in acute myocardial infarction and death.

The largest payment reported for an ob/gyn claim was $4 million. The primary allegation named in this claim was diagnostic error involving a newborn affected by other complications of labor and delivery. The procedure performed by the clinician was fetal monitoring, and the resulting medical condition was intrauterine hypoxia and birth asphyxia, leading to the death of the newborn.

TELEHEALTH CLAIMS MAY RISE

One area the MPL Association will be looking at closely in the near future is the impact of diagnosis via telehealth.

Telehealth has existed in primary care for a very long time, but virtual visits weren’t widely adopted until about five years ago, when Americans’ use of digital devices like smartphones reached a critical threshold. It wasn’t until the pandemic, though, that telehealth experienced enormous growth, as many providers were forced to start using it—to a degree that may be here to stay. There are obviously limitations to a virtual visit, so there is an inherently greater degree of uncertainty in telehealth diagnosis. That potential for error can be communicated to the patient during the virtual visit. “We’re hoping we don’t see an increase in diagnostic errors in telehealth, and managing patient expectations about the possibility of misdiagnosis could help mitigate that,” Parikh says.

A recent review of claims from 2014 to 2018—the years when telehealth started to take hold in a substantial way—showed that only 2% of claims and lawsuits involved a telehealth service, which ranged from phone calls with doctors to mobile health, remote patient monitoring, and live video conferencing.

During those four years, telemedicine closed claims resulting in an indemnity payment to the claimant totaled $71.2 million. The average indemnity payment was $220,520, and the largest payment was $3 million.

Medical specialties with the highest number of closed and paid telemedicine claims were primary care, ob/gyn, and dentistry.

The MPL Association plans to continue monitoring telemedicine claims as they may arise in the future.

PANDEMIC PICTURE UNCLEAR

It can take years for medical professional liability cases to close, so it will be some time before the Data Sharing Project will have the numbers to tell the story about diagnostic errors in any area during the pandemic.

Even in typical years, “medical liability claims data has a very long tail,” Parikh explains. But under the circumstances of the pandemic, it could take even longer. The court system itself has been slowed by the pandemic.

“There was a decrease in claims volume overall in 2020,” Parikh says. Some of that was due to federal and state immunity statutes and executive orders that protected clinicians who treated COVID-19 patients. Some of it could also be due to the “halo effect” of medical professionals being seen as heroes during the crisis. It could also be due to people delaying non-COVID-related testing and procedures because of the pandemic.

Parikh anticipates upward claims trends related to COVID-19 in long-term care down the road, as well as a return to claims volume norms as we emerge from the crisis.